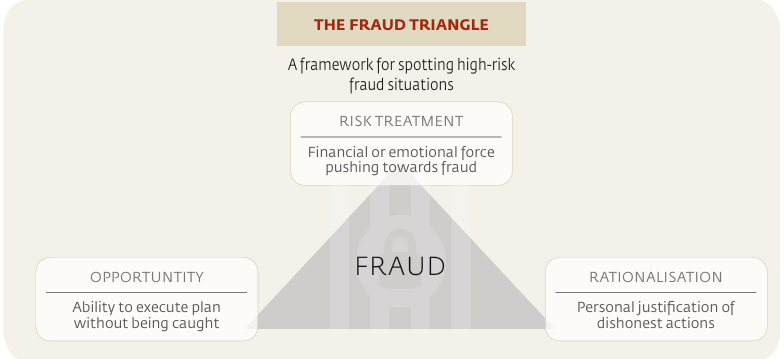

The Fraud Triangle¶

Fraud Triangle, a framework for understanding the factors that may lead to committing fraud. It outlines three key elements: opportunity, pressure, and rationalization. These elements are often referred to as the three legs of the fraud triangle. The fraud triangle is a useful tool for understanding the factors that may lead to committing fraud. It outlines three key elements: opportunity, pressure, and rationalization. These elements are often referred to as the three legs of the fraud triangle.

- Opportunity: This element of the triangle suggests that individuals commit fraud because they can; they have the means to execute the plan without being detected.

- Pressure (Risk Treatment): Here, individuals feel a financial or emotional force that compels them toward fraudulent behavior, often due to financial stress or unattainable performance targets.

- Rationalization: This is the mental process where individuals justify their fraudulent actions to themselves, often by downplaying the seriousness or shifting the blame to justify their dishonest actions.

Customer Fraud:

-

Customers Defrauding Agents:

-

Depositing counterfeit currency to exchange for electronic value or legitimate currency.

- Unauthorized access of agents' POS devices to perform fraudulent transactions.

- Unauthorized transactions via an agent’s web channel.

-

Creating and using fake vouchers to obtain cash or electronic value.

-

Customers Defrauding Customers:

- Gaining unauthorized access to other customers' PINs to conduct transactions.

- Identity theft to access other customers’ accounts.

- Phishing and SMS spoofing to deceive agents with seemingly legitimate messages.

Agent Fraud:

-

Agents Defrauding Customers:

-

Unauthorized access to customers' PINs for fraudulent transactions.

- Charging unauthorized fees and keeping them instead of remitting to the intended provider.

- Conducting split withdrawals to earn higher commissions, thereby defrauding customers.