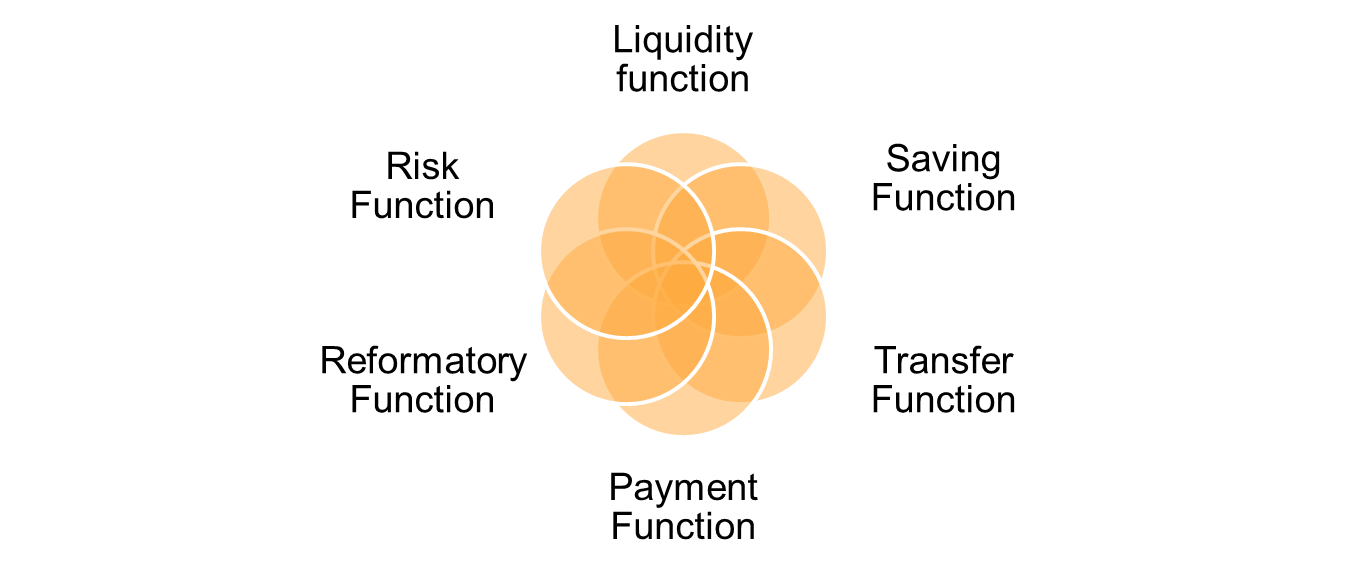

Functions of the Indian Financial System¶

The Indian financial system plays a crucial role in the country's economic development and growth. It encompasses various functions to facilitate the flow of funds, support financial stability, and meet the diverse needs of individuals and businesses.

1. Liquidity Function¶

Liquidity refers to the availability of cash or easily convertible assets to meet financial obligations. The Indian financial system ensures liquidity by:

- Providing access to banking services, including savings and current accounts.

- Offering liquid investment options like money market instruments.

- Facilitating quick and secure transactions through various payment systems.

2. Saving Function¶

The financial system in India encourages individuals and households to save and invest their surplus funds. Key components of the saving function include:

- Mobilizing savings through savings accounts, fixed deposits, and recurring deposit schemes.

- Promoting long-term wealth creation through investment products like mutual funds and pension plans.

3. Transfer Function¶

The transfer function of the Indian financial system involves the movement of funds from savers to borrowers. It supports economic growth by:

- Providing loans and credit to individuals, businesses, and government entities.

- Facilitating the transfer of funds between different sectors of the economy to finance investments and projects.

4. Payment Function¶

Efficient and secure payment systems are essential for businesses and individuals. The payment function includes:

- Enabling electronic funds transfer, online banking, and digital payment methods.

- Ensuring the smooth flow of funds between buyers and sellers, both domestically and internationally.

5. Reformatory Function¶

The Indian financial system plays a reformatory role by promoting financial inclusion and economic development:

- Expanding access to financial services for underserved and rural populations.

- Encouraging responsible lending and borrowing practices.

- Supporting inclusive growth by bringing more people into the formal financial sector.

6. Risk Function¶

Managing and mitigating financial risks is critical to the stability of the financial system. This function involves:

- Offering risk management products such as insurance, derivatives, and hedging strategies.

- Implementing regulations and supervision to ensure the safety and soundness of financial institutions.

- Protecting consumers and investors from fraudulent or unethical practices.

The Indian financial system continues to evolve, leveraging technological advancements and innovative solutions to meet the changing needs of a dynamic economy. It plays a pivotal role in fostering economic growth, financial stability, and inclusive development throughout the country.